For Schauer Group risk management clients, we follow a customized, strategic process in order to understand our clients’ businesses and deliver trusted risk management guidance.

We don’t just sell insurance policies; we immerse ourselves in our clients’ businesses to proactively reveal risks and protect their assets. By focusing on long-term relationships and partnering closely with our clients, we act more like risk management advisors than insurance brokers—offering dependable knowledge, guidance and advice our clients can trust long after enrolling in a program.

To deliver on our service promise, our people meet the highest industry standards. Education is at the foundation of our company, and our talented team of associates seek advanced designations/degrees in insurance and/or business.

This advanced education coupled with our time-tested risk analysis process supports a culture of first-class client service.

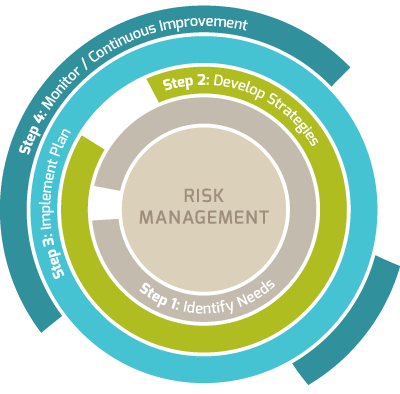

Our Risk Analysis Process

Step 1 – Identify client goals and risk exposures.

Step 2 – Develop a strategy around client goals and exposures.

Step 3 – Execute the strategy.

Step 4 – Continuous improvement and monitoring.

We invite you to take a more robust look at our risk management process, along with reviewing our expertise in insurance, human capital services, employee benefits and surety service areas.

The Nation's First ISO Registered Independent Insurance Agency

ISO 9001 is one of the most widely recognized quality standards in the world. It is a quality management standard that presents guidelines to increase business efficiency and customer satisfaction. The goal is to increase productivity, reduce unnecessary costs, and ensure quality of processes.

One important aspect of ISO 9001 is its process-oriented approach. Instead of looking at a company’s departments and individual processes, ISO 9001 requires that a company look at “the big picture.” ISO 9001 makes the customer its focus.